We're [finally] debt free!

Life advice from Carl.

As we reflected on 2019 in our recent video, we shared that in 2019 our biggest win was getting out of debt!

It’s been a long-time coming. Shortly after we were married in 2008, Jennifer started law school, which meant that we signed off on loan after loan to get her through private school.

By the time she graduated in 2011, we had close to $90,000 in school debt. Thankfully, we had been paying some interest along the way, but it was still a daunting number.

Jennifer and me in December 2010 - a few years married, but already in five figure debt!

Although we were in a dual income relationship, we weren’t organized with any kind of budget. Credit cards tempted us when we didn’t have cash on hand, a car loan became necessary after Elin was born, and we just got sloppy with finances. There was very little intentionality about any of it, and it started to make me anxious.

After Jennifer was diagnosed with breast cancer in 2018, I decided we had to do something about it. I couldn’t be stressed about her health and our financial situation.

Yes, I decided we should pay off our debt during one of the worst, most uncertain times in our relationship.

We made the commitment to start to budget and pay things down in May 2018. It wasn’t organized or pretty.

In November 2019, we made our final payment on the tens of thousands of dollars in debt we had started with the year before. We still have our mortgage, but that’s it.

Here is my best advice for how to get out of debt in 2020:

1 - Listen to people that you trust.

We had been in debt for years. I didn’t know how to just “get out of it.” We were in a pattern of behaviors that needed fresh ideas I didn’t have.

So, I started listening to Dave Ramsey.

Sure, not everyone agrees with his advice and that’s fine - you can’t argue as to whether his advice works. For years now, his Financial Peace University has been guiding people through a new way of financial thinking. We used Financial Peace and a listened to his podcast almost daily. The more I heard other people doing what we were trying to do, the more I believed we could do it.

We also changed financial advisors during this time. We found someone who was bought in on us becoming debt-free and could give us advice on how to get there. The person managing your money should be aligned with your own financial goals.

2 - Have an accountability partner.

It’s easier to stay focused and accomplish your goals when you have someone walking alongside you. It may be your spouse, a parent, a friend or coworker. Whoever it is, make sure that you have someone to help keep you accountable for the goals you’ve set. Share your budget with them and keep them updated on your monthly progress.

Check-in with your accountability partner on a monthly basis. Sometimes Jennifer and I would check-in weekly, especially at the beginning of the process, because we were still trying to figure things out. The more you talk about finances and the budget, the more likely you will be to stick to it.

It’s worth noting that it’s OK if one spouse is more excited about paying down debt than the other. Sometimes finances scare people, and it just takes more time for someone to get used to reviewing the numbers and step out of old habits. For Jennifer and me, we agreed that I would be our “finance manager.” While Jennifer had responsibilities in this process, too, I was the one who was coordinating and orchestrating the plan.

3 - Use simple tools. It doesn’t need to be complicated.

As I mentioned, we utilized the basics of Dave Ramsey’s Financial Peace program. As a budgeting tool, we used Every Dollar. It’s something both Jennifer and I can keep on our phones, connect it with our online banking tools, and craft our monthly budgets.

There are lots of things out there, but it doesn’t need to be fancy or overly complicated.

4 - Focus and stay committed.

The things you focus on are the things you will accomplish. While you shouldn’t obsess over your finances, keeping a constant eye on your account balance and monthly expenses is a healthy practice.

Where do you start? A budget. Don’t overthink it, though! Creating your budget is as simple as listing your monthly income and comparing it to your estimated monthly expenses. If you find that your estimated monthly expenses are higher than your monthly income, then you need to start trimming back your expenses.

After you set your budget, keep an eye on your expenses each week to make sure you’re on track. Create a new budget for each month and stay focused on the budget you built.

This took me MONTHS to get right. In the beginning, we kept going over our budgeted numbers, but eventually we got the hang of what we needed to be spending and how we needed to be planning for unexpected expenses.

Make a budget. Talk about it. Think ahead.

5 - Change your behavior and don’t look back.

Don’t worry so much about the numbers. Easy to say, harder to do! Our spending habits are usually wound tightly in our life experiences, and those habits can be hard to unwind.

We found that when we changed our mindset and habits related to our debt, it became much easier to start chipping away at the total.

We stopped using the credit cards as an alternative form of payment. We paid them off and got them out of our wallets.

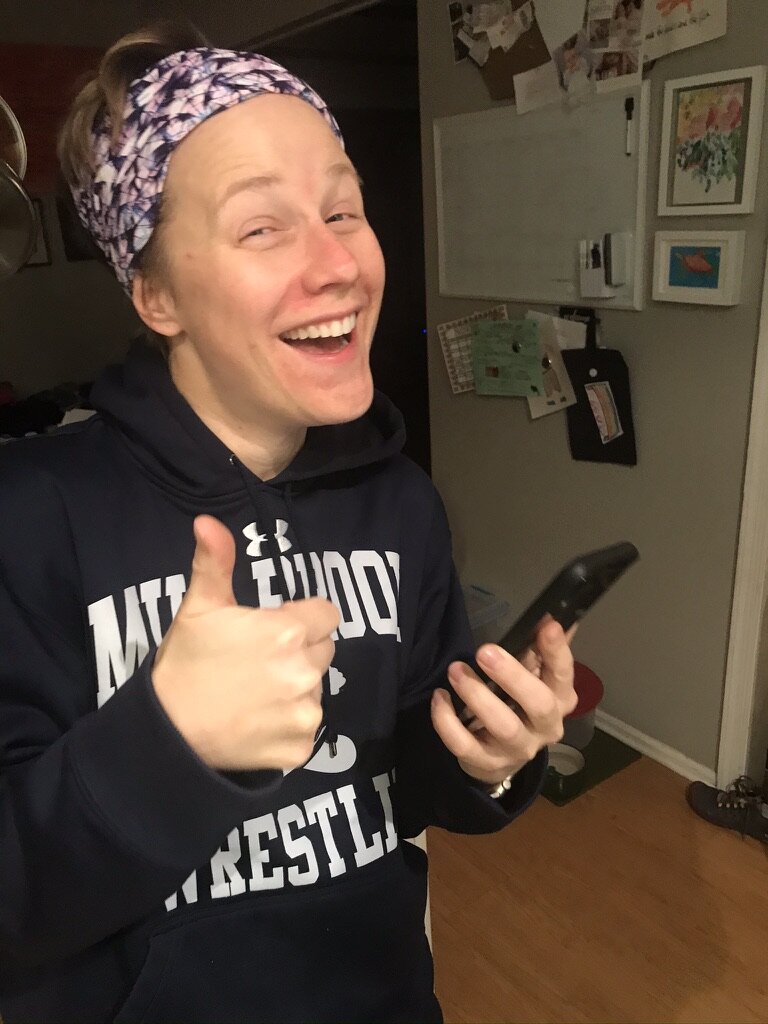

Jennifer pressed the “pay now” button for the final payment on our HELOC at 6:30 a.m. on November 26, 2019.

We said “no” to things and mindless spending. Jennifer utilized more delivery options from the grocery store and Target so we wouldn’t be tempted to go and purchase more than what was on our list. We only bought clothes when they were needed (which turned out to be rarely) and we didn’t buy decor for the house.

We stopped using the excuse “but it’s on sale!” If we needed to make a purchase, we looked for a deal. We didn’t let deals influence our behavior - our budget influenced our behavior.

We cut down on going out to eat and buying alcohol. We packed lunches for work, knowing we’d have to say no to some group outings. When we went out, we went to places we really enjoyed with food we couldn’t wait to eat.

We got creative - when the girls wanted a Barbie Dream House, Jennifer found a used one in great condition on Facebook. And similarly, we sold things that we didn’t use anymore but were still had lots of life left for someone else.

We automated monthly payments so we wouldn’t forget to make them. They were in the budget, so no sense in thinking about them more than necessary - we just wanted to get them paid!

Everyone’s situation is different, so this isn’t a “one-size fits all” solution. Make the necessary changes to your behavior that help you succeed.